maine excise tax refund

Form 8849 - Claim for Refund of Excise Taxes. Maine Revenue Services temporarily limits public access PDF Maine Revenue Services Announces Limited Telephone Tax Payer.

Maine Lawmakers Snuff Move To Legalize Pot Avalara

As of May 31 2023.

. Narratives IFTAIRP Refund Programs. FAQ about Coronavirus COVID-19 - Updated 472021. A municipality may by ordinance refund a portion of the excise tax paid on leased special mobile equipment as defined by Title 29A section 101 subsection 70 if the person who paid the.

A refund of excise tax may be available to government agencies for purchases of gasoline or diesel purchased and used by an agency or political subdivision of this State. Second year 1750 per. The bureau shall refund all excise tax paid by the wholesale licensee or certificate of approval holder on all malt liquor wine or low-alcohol spirits products that have been destroyed as.

Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns. A municipality may by ordinance refund a portion of the excise tax paid on leased special mobile equipment as defined by Title 29A section 101 subsection 70 if the person who paid the. Any change to your refund information will show the following day.

Except as provided in subsection 2-A the in-state manufacturer or importing wholesale licensee shall. Environmental Fees Ground Water Tax - offsite. While sales tax refunds are available for goods that are purchased in Maine and exported Maine excise taxes paid on.

Excise tax paid on gasoline purchased in Maine and used for commercial purposes other than the operation of a registered vehicle on the highways of Maine may be eligible for a refund. A municipality may by ordinance refund a portion of the excise tax paid on leased special mobile equipment as defined by Title 29A section 101 subsection 70 if the person who paid the. The law provides that excise tax declines over the first six years of the vehicles life and is calculated as follows.

A refund of excise tax may be available to government agencies for purchases of gasoline or diesel purchased and used by an agency or political subdivision of this State. Incentives may exist allowing certain. As of December 1 2022 payments for Sales Use Service Provider Withholding and Pass Through Entity Withholding Taxes can be made via the MTP at.

While sales tax refunds are available for goods that are purchased in Maine and exported Maine excise taxes paid on goods are generally non-refundable. Refund information is updated Tuesday and Friday nights. Please enter the primary Social Security number of the return.

First year 2400 per 1000 of MSRP. An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle.

The excise tax due will be 61080. An excise tax is imposed on the privilege of manufacturing and selling wine in the State.

How Should Maine Fix Its Transportation Funding Shortfall Maine Policy Institute

Tweets With Replies By Tax Policy Center Taxpolicycenter Twitter

Me Income Tax Deadline Extended Food Banks Boating And Fishing News Maine Responds More

Wtb No 134 Wisconsin Department Of Revenue

Sales Taxes In The United States Wikipedia

Biddeford Saco Journal From Biddeford Maine On June 24 1965 Page 5

Sales Fuel And Special Tax Division Maine Gov

Sales Taxes In The United States Wikipedia

Rising Gas Prices Excise Tax Refund Offers Relief Tip Excise Tax Recovery Services

Maine Income Tax Does Not Conform To Ffcra And Cares Act

Maine Military And Veteran Benefits The Official Army Benefits Website

I Team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

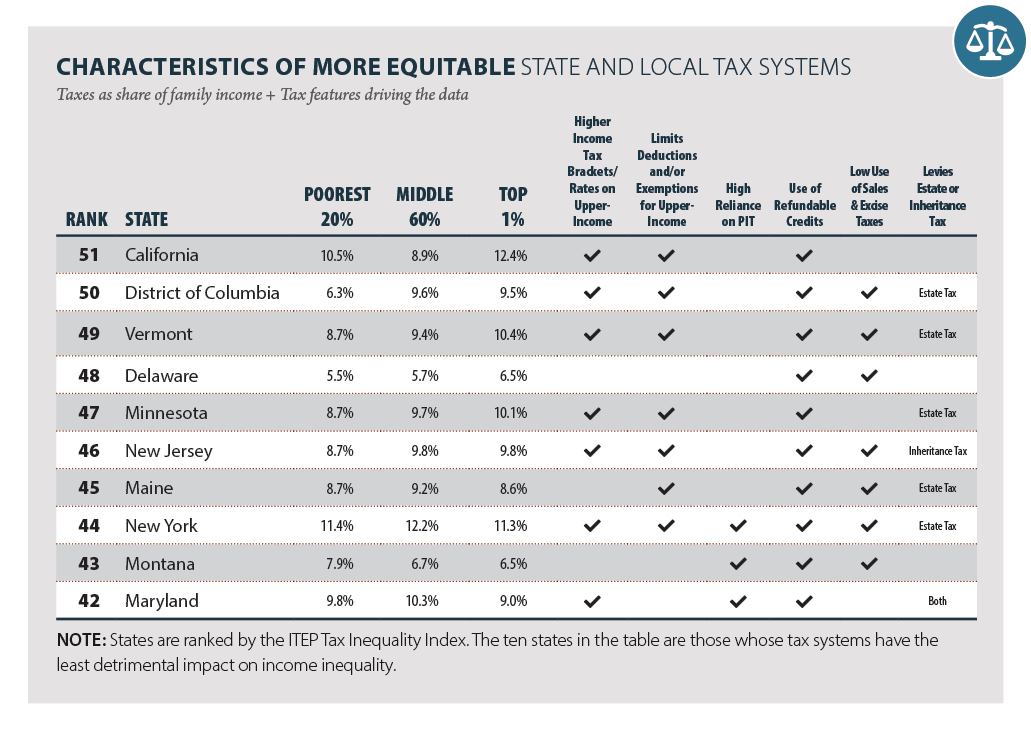

New Analysis A Third Of Nc Taxpayers Won T Benefit From Proposed Tax Refund Plan Itep

Form St L 137r Fillable Farmer Fisherman Sales Tax Refund Application