best buy 401k withdrawal

People do this for many. Two-thirds of large 401k plans allow retired.

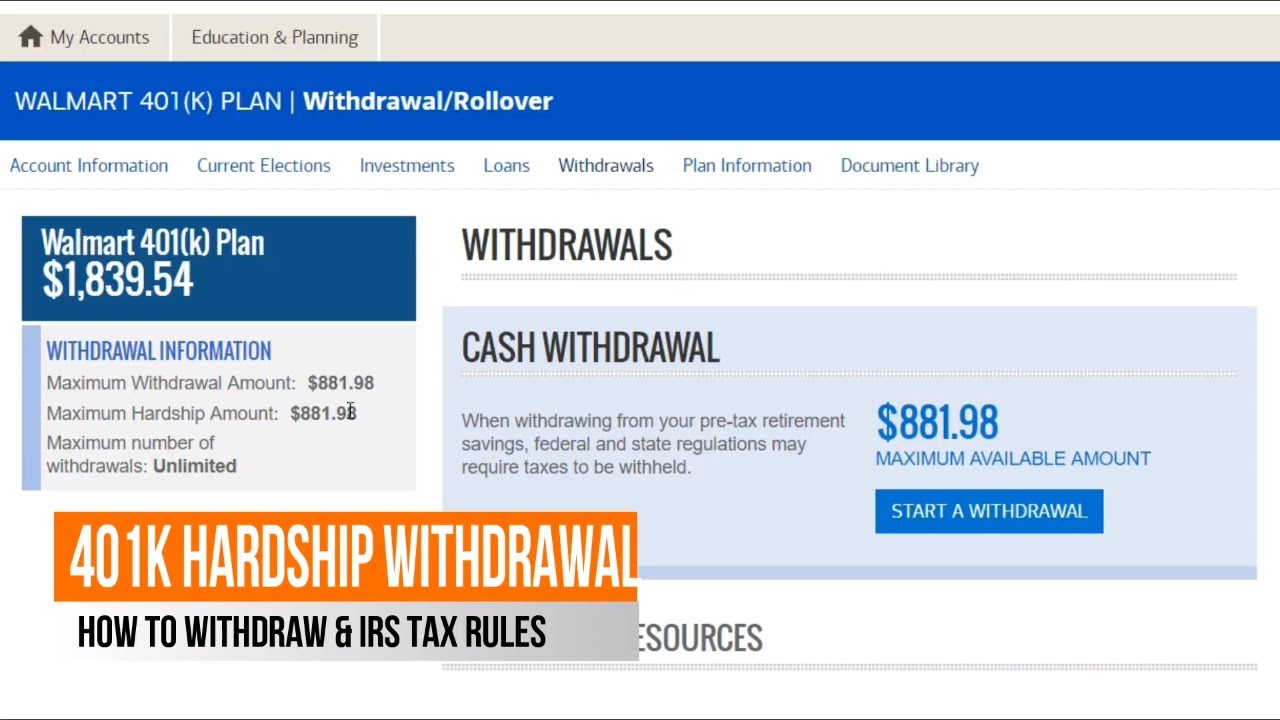

How To Take 401 K Hardship Withdrawals

Best buy 401k withdrawal 401k Withdrawal Rules For Home Purchases 2021.

. Best buy 401k withdrawal 401k. I need emergency funds. Learn about Best Buy 401K Plan including a description from the employer and comments and ratings.

You can roll over the funds from your Best Buy 401k into the new employers plan and effectively pay no penalty. Locate your order in Order Status section. If you need to cancel an order you placed online and get your funds returned you should.

Best buy 401k withdrawal 401k Withdrawal Rules For Home Purchases 2021 When Is It Ok To Withdraw Money Early From Your 401k. Choose An Ira Provider. Whether you can take regular withdrawals from your 401k plan when you retire depends on the rules for your employers plan.

2 votes and 13 comments so far on Reddit. Removing funds from your 401 k before you retire because of an immediate and heavy. All distributions are subject to ordinary income.

Step one is deciding where you want your money to go. If youre at least 59½ youre permitted to withdraw funds from your 401 k without penalty whether youre suffering from hardship or not. Call Best Buys customer service number.

Perhaps you would rather talk with a person on the phone to delete your rewards account. If at some point you get a check from the broker Is Best Buy still. This is certainly understandable if.

Can I Use My 401k To Buy A House. Under the IRS 401k withdrawal rules investors can begin making withdrawals after they turn 59 ½. Glassdoor is your resource for information about the 401K Plan benefits at Best Buy.

Removing funds from your 401 k before you retire because of an immediate and heavy financial need is called a hardship withdrawal. For example if you have 600000 in a 401 and. Getting a Best Buy Refund for Cancelations.

Withdrawing from a 401k in retirement. The IRS typically withholds 20 of. If you already have an IRA and would like to roll your funds.

This involves withdrawing money from taxable and tax-deferred accounts each year in proportion to your overall savings.

Forever Blue Best Buy Corporate News And Information

What Happens When You Make An Early 401 K Withdrawal Pai Com

Best Buy Mall Scam Alert Bestbuy Withdrawal Issue Bestbuy Scam Youtube

4 Reasons To Rethink Cashing Out Your 401 K Or Ira Early

22 Best Buy Hacks That Ll Save You Hundreds On Electronics The Krazy Coupon Lady

401 K Withdrawal Age And Early Withdrawal Rules Smartasset

Using A 401k Withdrawal To Invest In Real Estate Bills Com

Way Behind On The Bills A 401 K Hardship Withdrawal May Be Your Best Bet Markets And Stocks Nwitimes Com

:max_bytes(150000):strip_icc()/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-011-476fff8e835242c39a99ce76c52e8764.jpg)

401 K Loan 4 Reasons To Borrow Rules Regulations

Best Solo 401k Providers Comparing The Most Popular Solo 401k Options

How To Withdraw From Your 401 K Plan In Retirement Kiplinger

Can I Use My 401 K To Buy A House Updates For 2022

Tapping Your 401 K Is Now The Right Time To Do It

/401k-distributions-guide-2000-23a91cac68594852b0b63bb2e5b9d69a.jpg)

How 401 K Distributions Work Using Your 401 K In Retirement

3 Things To Know About 401 K Distributions The Motley Fool

A Complete Guide To Moving Your 401k To Gold Without Penalty Top 3 Gold Ira Companies For 401k Rollovers

How To Withdraw From 401k Or Ira For The Down Payment On A House

:max_bytes(150000):strip_icc()/GettyImages-534599661-42322be5b1f047229707b9f8bbce84b5.jpg)

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)